ब्रेकिङ न्युज

- पहाडी भेगमा आंशिक बदली, बाँकी भागमा मौसम सफा रहने

- जीवन बीमा कम्पनीहरूको कुल बीमा शुल्क आर्जन १ खर्ब माथि, नेपाल लाइफको अग्रता कायम...

- भोलिदेखि कक्षा १२ को परीक्षा; तीन लाख ९० हजार आठ सय ४७ परीक्षार्थी सहभागी हुँदै

- निजी क्षेत्रको मनोबल उकास्न सरकारले महत्त्वपूर्ण निर्णय गर्छ : अर्थमन्त्री पुन

- नेपाल र कतार बिचको समझदारी ऐतिहासिक छन् : राजदूत डा. ढकाल

साताको पहिलो कारोबार दिन धितोपत्र बजारमा १२.२९ अङ्कको वृद्धि

साताको पहिलो कारोबार दिन धितोपत्र बजारमा १२.२९ अङ्...

धितोपत्र बजारमा १९.५६ अङ्कको गिरावट, नेप्से १९७२.१४ को विन्दुमा

धितोपत्र बजारमा १९.५६ अङ्कको गिरावट, नेप्से १९७२.१...

विश्व इतिहासमा आज

संसारको एक मात्र यहुदी देश इजरायलका अनौठा तथ्यहरू

मुद्रास्फीति: परिचय र प्रकार

सबैभन्दा महँगो गितार

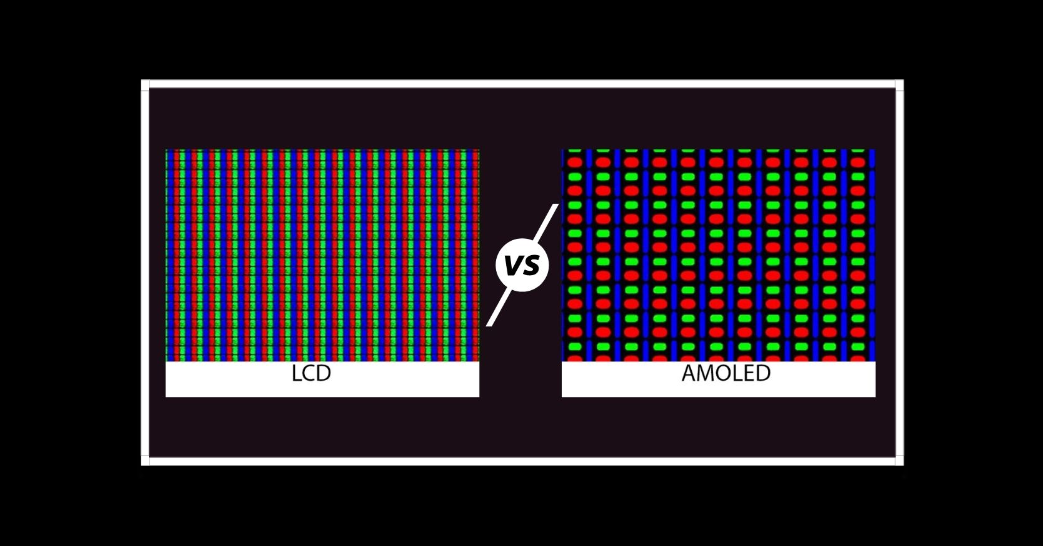

LCD र AMOLED डिस्प्ले: परिचय र भिन्नता

फुटबलको विकासका लागि ‘एन्फा कम्युनिटी कोचिङ’

आइपिएलको उद्घाटन खेलमा चेन्नई विजयी

राष्ट्रिय महिला भलिबलको उपाधि एपिएफलाई

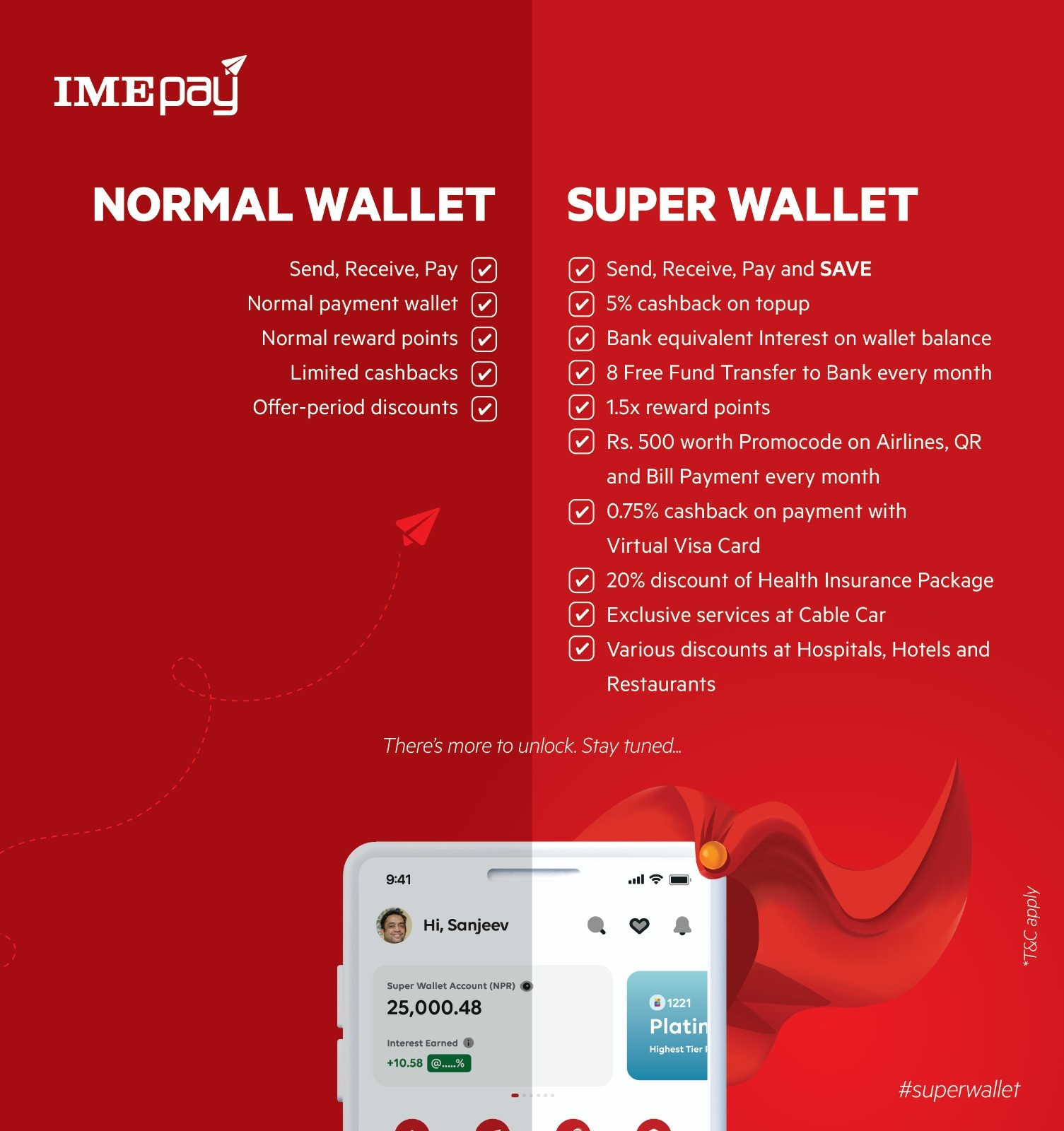

आइएमई पे नेपाल सुपर लिग २०२३ को आधिकारिक टिकेटिङ पार्टनरको र...

Nepal Telecom

01-4210283

Bhadrakali Plaza, Kathmandu Nepal

https://www.ntc.net.np/

Ncell Axiata Limited

+977 980 555 4444

Lainchaur, Kathmandu

https://www.ncell.axiata.com/en